But our experienced online advisors are here to help! With access to exclusive mortgage deals and tailored advice based on your individual financial situation, we will work with you every step of the way so that you get the best mortgage for your needs. Trying to make a choice between the array of mortgages out there can be daunting.

A standard repayment mortgage may be a better alternative for you, despite the higher repayments, if you are worried about paying the capital at the end of your term.

#60000 interest only mortgage calculator full#

You also have to make the capital repayment in full at the end of your mortgage.

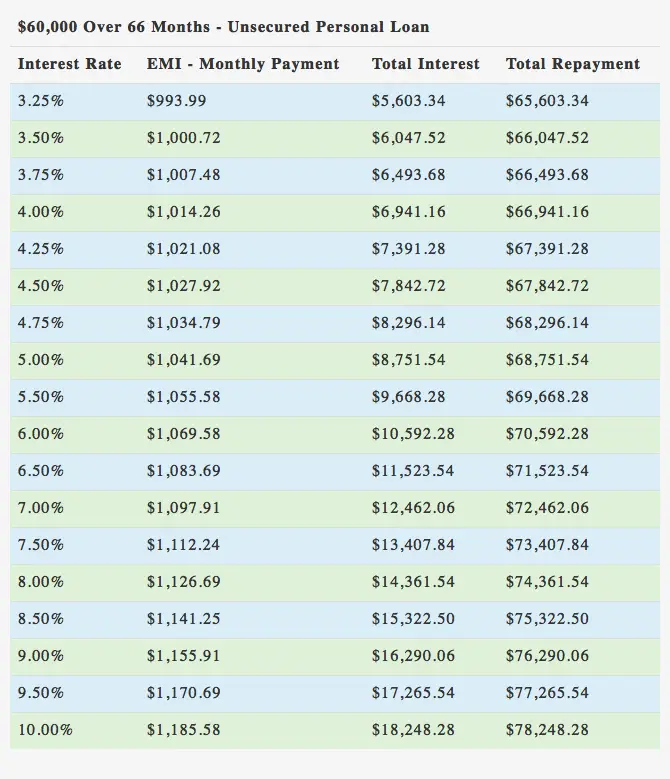

However, an interest-only mortgage usually can come with a higher rate of interest, so this might not be the cheapest overall option for you. Interest-only mortgage: Your monthly repayments will be lower as you only pay the interest on your mortgage. If the base rate is low, this can make your mortgage more affordable than some fixed-rate mortgages, but if the base rate increases, you may have to pay more interest than someone on a fixed mortgage deal. Tracker mortgage: Tracker mortgage interest rates will change in line with the Bank of England base rate during the duration of your mortgage. At the end of the timescale, you can negotiate a new mortgage fixed term rate, or you can let your mortgage revert to your lender’s standard variable rate. The interest on your mortgage will be calculated differently depending on the type of mortgage you choose.įixed-rate mortgage: Your interest rate will be fixed over a set period of time. How does the mortgage type affect £600,000 monthly mortgage payment? We have rounded the amounts to the nearest £. The table above is based on a £600,000 mortgage with an interest rate of 5%. The table and graph below indicate how much you will be expected to pay on a £600k mortgage at 5% interest between 5 and 30 years. When deciding on the loan term, it is advisable to consider how much you can feasibly afford to pay each month. Short-term mortgages come with lower interest rates, but the monthly repayment will be higher because the mortgage will be spread over a smaller period. This will help you make savings each month, although it’s worth noting that the total capital repayment of your mortgage will be larger due to the extra and total interest paid over the lifetime of the loan. It’s sometimes advisable to opt for a longer term as this is one way to reduce your monthly repayments. Mortgages are usually 25 years in length, but you can take out a mortgage over a shorter or a longer term if you prefer. Increasing the size of your deposit Improving your credit score Choosing your loan term carefully Shopping around for a more affordable mortgage How does the mortgage term affect monthly mortgage payments? You can reduce the monthly repayment interest total on your mortgage by: Therefore, it’s crucial to take the necessary steps to secure a lower interest rate on your mortgage to reduce the monthly repayment interest total. The higher the monthly interest rate, the higher your monthly repayment will be. The rate you are offered will depend on the size of your deposit, your credit history, and the mortgage type. Most lenders offer interest rates from 4% – 6%. How does the interest rate affect the £600,000 mortgage monthly repayments? This guide explains what affects the repayments of a £600,00 mortgage and what you can do to qualify for a mortgage of this size. However, the total cost will rely heavily upon several personal financial factors such as: The mortgage repayments on a £600,000 mortgage will be £3,502 a month based on a mortgage rate of 5% on a 25-year term. Utilise these key points to help reduce any challenges related to taking on such a large debt and make sure that your financial goals are achievable! £600000 mortgage repayments This amount of mortgage is three times the average mortgage in the UK so it will likely require an elevated level of income along with additional requirements explored in this guide.

If you’re seeking to purchase your dream home with a £500000 mortgage, it is essential that you research and understand the associated monthly repayments.

0 kommentar(er)

0 kommentar(er)